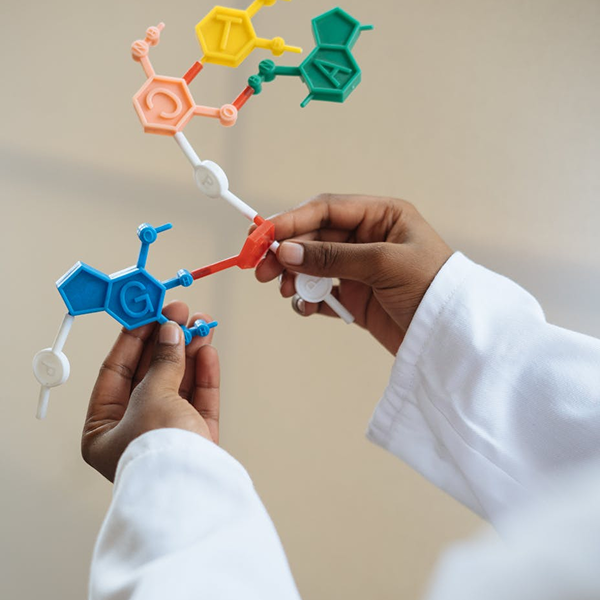

The Problem

Developing or distributing medical products, supplements, or biotechnology carries the risk of side effects, contamination, or defects that can cause injury or damage. These claims can be financially devastating and harm your reputation.

Our Solution

We provide Product Liability cover options that assist with the cost of defending and settling claims related to defective or harmful products, helping you maintain compliance and business continuity.