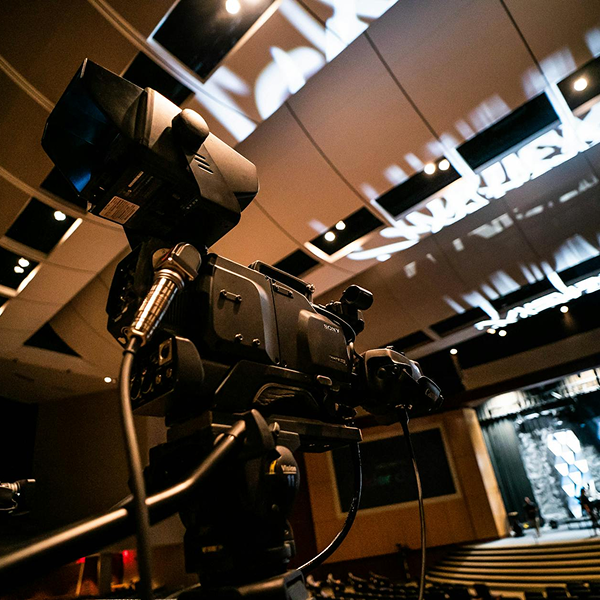

Media

The media industry is dynamic, creative, and fast-moving but it also carries serious risks involving intellectual property, defamation, cyber incidents, and content liability. Whether you're running a production company, news outlet, advertising agency, or digital content platform, protecting your operations and reputation is essential.

At Angelic Insurance, we provide general advice to help media businesses explore cover options such as public liability, professional indemnity, media liability, cyber liability, and equipment protection. We compare policies from leading insurers that understand the legal and operational challenges faced by traditional and digital media organisations.

From independent publishers to national broadcasters and content creators, we help ensure your business has coverage options suited to its output and audience.